Indian Budget

The Constitution refers to the budget as the ‘annual financial statement’. In other words, the term ‘budget’ has nowhere been used in the Constitution. It is the popular name for the ‘annual financial statement’ that has been dealt with in Article 112 of the Constitution.

The budget is a statement of the estimated receipts and expenditure of the Government of India in a financial year, which begins on 1 April and ends on 31 March of the following year. In addition to the estimates of receipts and expenditure, the budget contains certain other elements. Overall, the budget

contains the following:

- Estimates of revenue and capital receipts;

- Ways and means to raise the revenue;

- Estimates of expenditure;

- Details of the actual receipts and expenditure of the closing financial year and the reasons for any deficit or surplus in that year; and

- Economic and financial policy of the coming year, that is, taxation proposals, prospects of revenue, spending programme and introduction of new schemes/projects.

The Railway Budget was separated from the General Budget in 1924 on the recommendations of the Acworth Committee Report (1921). In 2017, the Central Government merged the railway budget into the general budget. Hence, there is now only one budget for the Government of India i.e., Union Budget.

Constitutional Provisions

The Constitution of India contains the following provisions with regard to the enactment of the budget:

- The President shall in respect of every financial year cause to be laid before both the Houses of Parliament a statement of estimated receipts and expenditure of the Government of India for that year.

- No demand for a grant shall be made except on the recommendation of the President.

- No money shall be withdrawn from the Consolidated Fund of India except under appropriation made by law.

- No money bill imposing tax shall be introduced in the Parliament except on the recommendation of the President, and such a bill shall not be introduced in the Rajya Sabha.

- No tax shall be levied or collected except by authority of law. Parliament can reduce or abolish a tax but cannot increase it.

- A money bill or finance bill dealing with taxation cannot be introduced in the Rajya Sabha–it must be introduced only in the Lok Sabha.

- The Rajya Sabha has no power to vote on the demand for grants; it is the exclusive privilege of the Lok Sabha.

- The Rajya Sabha should return the Money bill (or Finance bill) to the Lok Sabha within fourteen days. The Lok Sabha can either accept or reject the recommendations made by Rajya Sabha in this regard.

- The estimates of expenditure embodied in the budget shall show separately the expenditure charged on the Consolidated Fund of India and the expenditure made from the Consolidated Fund of India.

- The expenditure charged on the Consolidated Fund of India shall not be submitted to the vote of Parliament. However, it can be discussed by the Parliament.

Charged Expenditure

The budget consists of two types of expenditure–the expenditure ‘charged’ upon the Consolidated Fund of India and the expenditure ‘made’ from the Consolidated Fund of India. The charged expenditure is non-votable by the Parliament, that is, it can only be discussed by the Parliament, while the other type has to be voted by the Parliament. The list of the charged expenditure is as follows:

- Emoluments and allowances of the President and other expenditure relating to his office.

- Salaries and allowances of the Chairman and the Deputy Chairman of the Rajya Sabha and the Speaker and the Deputy Speaker of the Lok Sabha.

- Salaries, allowances and pensions of the judges of the Supreme Court.

- Pensions of the judges of high courts.

- Salary, allowances and pension of the Comptroller and Auditor General of India.

- Salaries, allowances and pension of the chairman and members of the Union Public Service Commission.

- Administrative expenses of the Supreme Court, the office of the Comptroller and Auditor General of India and the Union Public Service Commission including the salaries, allowances and pensions of the persons serving in these offices.

- The debt charges for which the Government of India is liable

- Any sum required to satisfy any judgement, decree or award of any court or arbitral tribunal.

- Any other expenditure declared by the Parliament to be so charged.

Stages in Enactment

The budget goes through the following six stages in the Parliament:

- Presentation of budget.

- General discussion.

- Scrutiny by departmental committees.

- Voting on demands for grants.

- Passing of appropriation bill.

- Passing of finance bill.

Voting on Demands for Grants

In the light of the reports of the departmental standing committees, the Lok Sabha takes up voting of demands for grants.

- Two points should be noted in this context. One, the voting of demands for grants is the exclusive privilege of the Lok Sabha, that is, the Rajya Sabha has no power of voting the demands.

- Second, the voting is confined to the votable part of the budget– the expenditure charged on the Consolidated Fund of India is not submitted to the vote (it can only be discussed).

On the last day of the days allotted for discussion and voting on the demands for grants, the Speaker puts all the remaining demands to vote and disposes them whether they have been discussed by the members or not. This is known as ‘guillotine’.

Passing of Appropriation Bill

The Constitution states that ‘no money shall be withdrawn from the Consolidated Fund of India except under appropriation made by law’. Accordingly, an appropriation bill is introduced to provide for the appropriation, out of the Consolidated Fund of India, all money required to meet:

(a) The grants voted by the Lok Sabha.

(b) The expenditure charged on the Consolidated Fund of India.

No such amendment can be proposed to the appropriation bill in either house of the Parliament that will have the effect of varying the amount or altering the destination of any grant voted, or of varying the amount of any expenditure charged on the Consolidated Fund of India.

Funds

The Constitution of India provides for the following three kinds of funds for the Central government:

- Consolidated Fund of India (Article 266)

- Public Account of India (Article 266)

- Contingency Fund of India (Article 267)

Consolidated Fund of India

It is a fund to which all receipts are credited and all payments are debited. In other words, (a) all revenues received by the Government of India; (b) all loans raised by the Government by the issue of treasury bills, loans or ways and means of advances; and (c) all money received by the government in repayment of loans forms the Consolidated Fund of India. All the legally authorised payments on behalf of the Government of India are made out of this fund. No money out of this fund can be appropriated (issued or drawn) except in accordance with a parliamentary law.

- This is the most important of all accounts of the government.

- This fund is filled by:

- Direct and indirect taxes Loans taken by the Indian government

- Returning of loans/interests of loans to the government by anyone/agency that has taken it

- The government meets all its expenditure from this fund.

- The government needs parliamentary approval to withdraw money from this fund.

- The provision for this fund is given in Article 266(1) of the Constitution of India.

- Each state can have its own Consolidated Fund of the state with similar provisions.

- The Comptroller and Auditor General of India audits these funds and reports to the relevant legislatures on their management.

Public Account of India

All other public money (other than those which are credited to the Consolidated Fund of India) received by or on behalf of the Government of India shall be credited to the Public Account of India. This includes provident fund deposits, judicial deposits, savings bank deposits, departmental deposits, remittances, and so on. This account is operated by executive action, that is, the payments from this account can by made without parliamentary appropriation. Such payments are mostly in the nature of banking transactions.

- This is constituted under Article 266(2) of the Constitution.

- All other public money (other than those covered under the Consolidated Fund of India) received by or on behalf of the Indian Government are credited to this account/fund.

- This is made up of:

- Bank savings account of the various ministries/departments

- National small savings fund, defense fund

- National Investment Fund (money earned from disinvestment)

- National Calamity & Contingency Fund (NCCF) (for Disaster Management)

- Provident fund, Postal insurance, etc.

- The government does not need permission to take advances from this account.

- Each state can have its own similar accounts.

- The audit of all the expenditure from the Public Account of India is taken up by the CAG

Contingency Fund of India

The Constitution authorized the Parliament to establish a ‘Contingency Fund of India’, into which amounts determined by law are paid from time to time. Accordingly, the Parliament enacted the contingency fund of India Act in 1950. This fund is placed at the disposal of the president, and he can make advances out of it to meet unforeseen expenditure pending its authorization by the Parliament. The fund is held by the finance secretary on behalf of the president. Like the public account of India, it is also operated by executive action.

- Provision for this fund is made in Article 267(1) of the Constitution of India.

- Its corpus is Rs. 500 crores.

- The Secretary, Finance Ministry holds this fund on behalf of the President of India.

- This fund is used to meet unexpected or unforeseen expenditure.

- Each state can have its own contingency fund.

| Fund | Consolidated Fund of India | Contingency Fund of India | Public Account of India |

| Income | Taxes and non-tax revenue | Fixed corpus of Rs. 500 crore | Public money other than those under consolidated fund |

| Expenditure | All expenditure | Unforeseen expenditure | Public money other than those under consolidated fund |

| Parliamentary Authorisation | Required prior to expenditure | Required after the expenditure | Not required |

| Articles of Constitution | 266(1) | 267(1) | 266(2) |

Types of Budget

Performance and Programme Budgeting

- In this budget the chosen programmes are subjected to the tests of actual performance against their expected standards.

- It establishes a correlation between physical (output) & financial (input) aspects of each programme and activity.

- It was introduced in India in 1968 for 4 ministries and in 1975-76 for all developmental departments.

Outcome Budget

- It is the compilation of anticipated and intended outcomes of various ministries.

- Outcome means the benefits arise out of physical output from respective financial input.

- 1st outcome Budget was introduced in August 25, 2005.

Zero based Budget

- Zero-based budgeting (ZBB) is a budgeting approach that involves developing a new budget from scratch every time (i.e., starting from “zero”), versus starting with the previous period’s budget and adjusting it as needed.

- Zero-based Budget can remove redundant spending by re-examining potentially unnecessary expenditures.

- Finance ministry has the plan to introduce it in future.

- Zero Based Budget in India was initiated in the Department of Science and Technology in 1983.

- In 1986, the Indian government implemented ZBB as a system for determining Expenditure Budget.

- The government made it compulsory for all ministries to review their activities and programmes and prepare their expenditure estimations based on the concept of ZBB.

- In the seventh Five-Year Plan, the ZBB system was promoted.

Receipt

Every receiving or accrual of money to a government by revenue and non-revenue (capital) sources is a receipt. Their sum is called total receipts.

Receipts = Revenue Receipts + Capital Receipts

Revenue Receipts

- Revenue receipts of a government are of two kinds—Tax Revenue Receipts and Non-tax Revenue Receipts.

- Tax Revenue Receipts

- This includes all money earned by the government via the different taxes the government collects, i.e., all direct and indirect tax collections.

- Non-tax Revenue Receipts : This includes all money earned by the government from sources other then taxes. In India they are:

- (i) Profits and dividends which the government gets from its public sector undertakings (PSUs).

- (ii) Interests received by the government

- (iii) Fiscal services i.e., currency printing, stamp printing, coinage and medals minting, etc.

- (iv) General Services like power distribution, irrigation, banking, insurance, community services, etc.

- (v) Fees, Penalties and fines received by the government.

- (vi) Grants which the governments receive—it is always external in the case of the Central Government and internal in the case of state governments.

Capital Receipts

All non-revenue receipts of a government are known as capital receipts. Such receipts are for investment purposes and supposed to be spent on plan development by a government. The capital receipts in India include the following :

- (i) Loan Recovery : This is one source of the capital receipts. The interests which come to the government on such loans are part of the revenue receipts.

- (ii) Borrowings by the Government : This includes all long-term loans raised by the government inside the country (i.e., internal borrowings) and outside the country (i.e., external borrowings).

- (iii) Other Receipts by the Government This includes many long-term capital accruals to the government through the Provident fund (PF), Postal Deposits, various small saving schemes (SSSs) and the government bonds sold to the public (as Indira Vikas Patra, kisan Vikas Patra, Market Stabilisation Bond, etc.). Such receipts are nothing but a kind of loan on which the government needs to pay interests on their maturities.

Expenditures

Expenditure = Revenue Expenditure + Capital Expenditure

Revenue Expenditure

- (i) Interest payment by the government on the internal and external loans;

- (ii) Salaries, Pension and Provident Fund paid by the government to government employees;

- (iii) Subsidies forwarded to all sectors by the government;

- (iv) Defence expenditures by the government;

- (v) Postal Deficits of the government;

- (vi) Law and order expenditures (i.e., police & paramilitary);

- (vii) Expenditures on social services (includes all social sector expenditures as education, health care, social security, poverty alleviation, etc.) and general services (tax collection, etc.);

- (viii) Grants given by the government to Indian states and foreign countries.

Capital Expenditure

- (i) Loan Disbursals by the Government

- (ii) Loan Repayments by the Government

- (iii) Plan Expenditure of the Government

- (iv) Capital Expenditures on Defence by the Government

- (v) General Services like railways, postal department, water supply, education, rural extension, etc.

- (vi) Other Liabilities of the Government Basically, this includes all the repayment liabilities of the government on the items of the Other Receipts.

Deficit

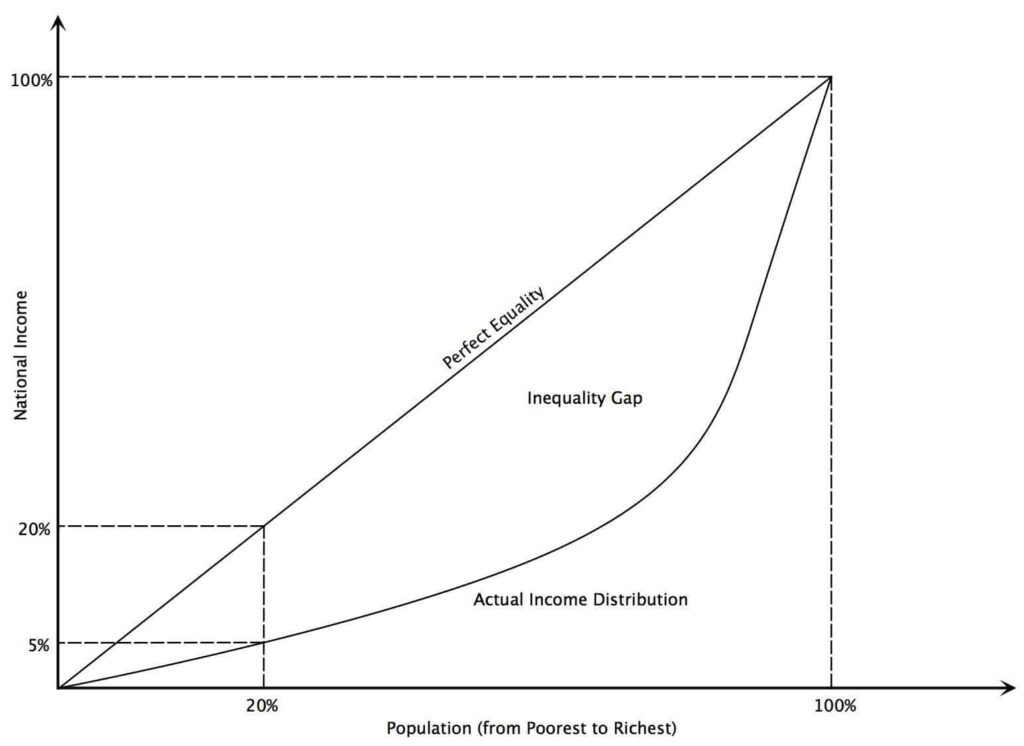

The gap between the receipts and expenditure is called deficit.

- Budget Deficit = Total Expenditure – Total Receipts

- Revenue Deficit = Revenue Expenditure – Revenue Receipts

- Fiscal Deficit = Total Expenditure – Total Receipts except Borrowing and Other liabilities

- Primary Deficit = Fiscal Deficit – Interest Payment

- Monetised Deficit = Borrowing from RBI + Draw down balance of government from RBI

- Effective revenue deficit is defined as the difference between revenue deficit and grants for creation of capital assets.

Also refer: