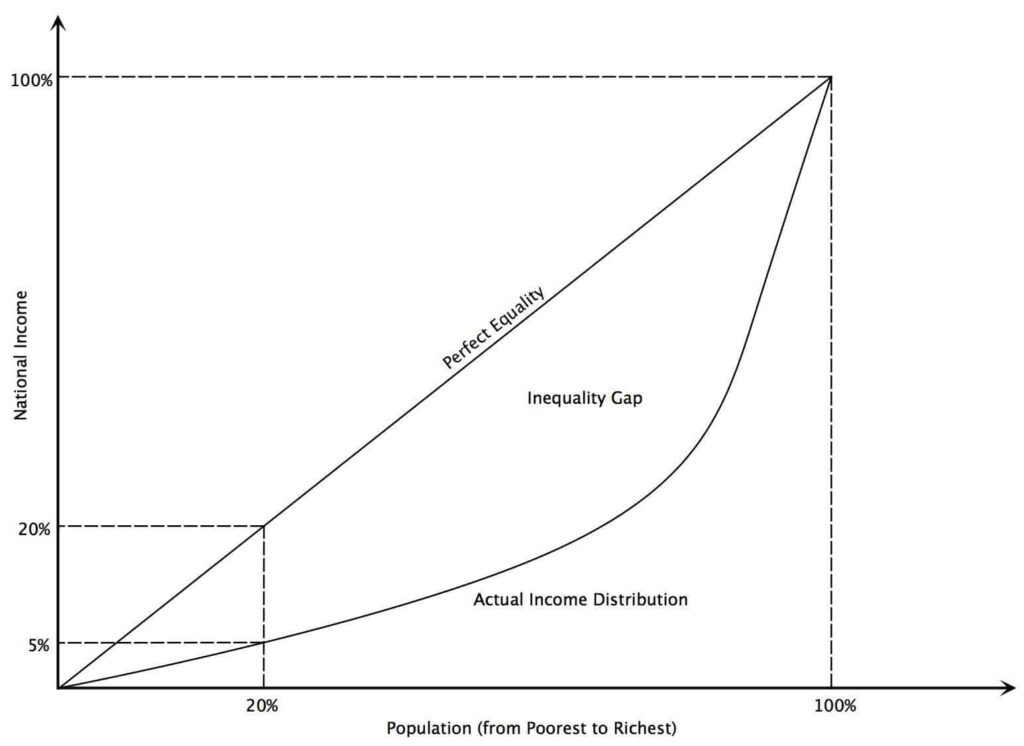

In layman terms, inflation is just a price rise. However, it is defined as a general rise in the price level in an economy over a period of time. If the price of one good has gone up, it is not inflation; it is inflation only if the prices of most goods have gone up.

- Often expressed as a percentage, inflation indicates a decrease in the purchasing power of a nation’s currency.

- Inflation can be viewed positively or negatively depending on the individual viewpoint.

- Those with tangible assets, like property or stocked commodities, may like to see some inflation as that raises the value of their assets.

- People holding cash may not like inflation, as it erodes the value of their cash holdings.

- Ideally, an optimum level of inflation is required to promote spending to a certain extent instead of saving, thereby nurturing economic growth.

Understanding Inflation

- As prices rise, a single unit of currency loses value as it buys fewer goods and services. This loss of purchasing power impacts the general cost of living for the common public which ultimately leads to a deceleration in economic growth. The consensus view among economists is that sustained inflation occurs when a nation’s money supply growth outpaces economic growth.

- To combat this, a country’s appropriate monetary authority, like the central bank, then takes the necessary measures to keep inflation within permissible limits and keep the economy running smoothly.

- Inflation is measured in a variety of ways depending upon the types of goods and a service considered and is the opposite of deflation which indicates a general decline occurring in prices for goods and services when the inflation rate falls below 0%.

Causes of Inflation

Demand Pull factors:

A mismatch between demand and supply pulls up prices. Either the demand increases over the same level of supply, or the supply decreases with the same level of demand and thus the situation of demand-pull inflation arise. This was a Keynesian idea. The Keynesian School suggests cuts in spending as the way of tackling excess demand mainly by increasing taxes and reducing government expenditure. For the monetarists, a demand-pull inflation is creation of extra purchasing power to the consumer over the same level of production (which happens due to wage revisions at the micro level and deficit financing at the macro level). This is the typical case of creating extra money (either by printing or public borrowing) without equivalent creation in production/supply, i.e., ‘too much money chasing too little output’—the ultimate source of demand-pull inflation. Different demand pull factors are explained below:

- Increase in Money Supply

- It leads to price rise. More money available with people induces people to purchase more goods and services. It means there is an increase in demand. So, prices move upward.

- Cheap Monetary Policy

- It means loans availability at very low interest rate and at easy terms. It leads to more investment by investors with loaned money. It pushes up the demand for capital goods and rise in price of the same.

- Increased government expenditure

- results in increased demand for goods and services and consequent increase in prices. This is because increased government expenditure results in putting large money in the hands of public, thereby putting to affect too much money chasing too few goods.

- Repayment of Public Debt :

- The repayment of public debt borrowed by government to public leaves people with more money. It induces people to spend more. It ultimately leads to increase in price of goods and services.

- Rising population:

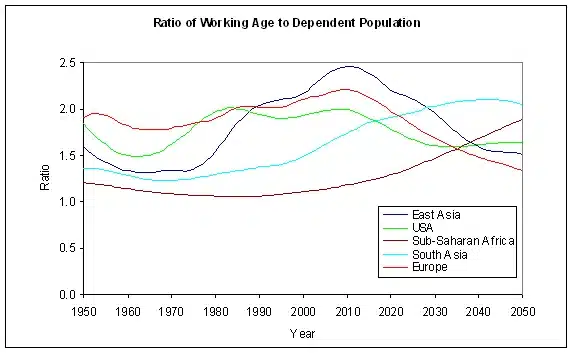

- Increasing population also acts as an important factor in pushing up prices because of increased demand especially when the supply is unable to meet the demand.

- Black Money:

- A large part of the black money is used in buying and selling of real estate in urban areas, extensive hoarding and black marketing in essential wage goods, such as cereals, pulses, etc. Black money, therefore, fuels demands and leads to rise in prices.

- Changing consumption patterns:

- Reserve Bank of India (RBI) put forward the theory that the inflation problem in India has its roots in a sharp increase in demand for certain food items that people eat more frequently as incomes rise. One example is protein-rich food. Increased consumption of pulses, eggs, fish and poultry were apparently driving up their prices in the economy.

Cost- Push Factors:

An increase in factor input costs (i.e., wages and raw materials) pushes up prices. The price rise which is the result of increase in the production cost is cost-push inflation. The Keynesian school suggested controls on prices and incomes as direct ways of checking such an inflation and, ‘moral suasions’ and measures to reduce the monopoly power of trade unions as indirect measures. Today, the governments of the world use many tools to check such inflations—reducing excise and custom duties on raw materials, wage revisions, etc. For the monetarists, ‘cost-push’ is not a truly independent theory of inflation—it has to be financed by some extra money (which is created by the government via wage revision, public borrowing, printing of currency, etc.). Different cost-push factors are explained below :

- The shortage in the factors of production viz., land, labour, and capital increases the cost of production. For example, shortage in the labour leads to higher wages. It increases the cost of production and price of goods and services.

- At times rise in wages, if greater than rise in productivity, increases the costs therefore increasing the prices too.

- Increase in indirect taxes also leads to cost side inflation. Taxes such as custom and excise duty raise the cost of production as these taxes are levied on commodities.

- Increase in administered prices such as the MSP (Minimum Support Price) for the food grains, petroleum products, etc also leads to inflation as they have a huge share in budget of common citizens.

- Infrastructural bottlenecks such as the lack of proper roads, electricity, water, etc. rise per unit cost of production. This is one of the prime reasons for inflation in the context of Indian economy.

- Owing to events such as failed monsoons there is a drop in agricultural productivity, which inevitably results in inflation at times.

- Increase in export of a particular commodity leads to shortage of goods in the domestic market. It pushes up prices.

- International factors like oil price hike, shortage in production of certain commodities leads to higher import prices.

- Industrial disputes lead to strike or lay off. It affects the production and supply of goods. It results in increased prices.

- Activities like hoarding and speculative trading in commodities in the commodities future market, result in price hike.

Types of Inflation

A. On the Basis of Causes:

- Currency inflation : This type of inflation is caused by the printing of currency notes.

- Credit inflation: Being profit-making institutions, commercial banks sanction more loans and advances to the public than what the economy needs. Such credit expansion leads to a rise in price level.

- Deficit-induced inflation: The budget of the government reflects a deficit when expenditure exceeds revenue. To meet this gap, the government may ask the central bank to print additional money. Since pumping of additional money is required to meet the budget deficit, any price rise may be called the deficit-induced inflation.

- Demand- Pull inflation: An increase in aggregate demand over the available output leads to a rise in the price level. Such inflation is called demand-pull inflation (henceforth DPI). But why does aggregate demand rise? Classical economists attribute this rise in aggregate demand to money supply. If the supply of money in an economy exceeds the available goods and services, DPI appears. It has been described by Coulborn as a situation of “too much money chasing too few goods.”

- Cost-push inflation: Inflation in an economy may arise from the overall increase in the cost of production. This type of inflation is known as cost-push inflation (henceforth CPI). Cost of production may rise due to an increase in the prices of raw materials, wages, etc. Often trade unions are blamed for wage rise since wage rate is not completely market-determined. Higher wage means high cost of production. Prices of commodities are thereby increased.

B. On the Basis of Speed or Intensity:

- Creeping or Mild Inflation: If the speed of upward thrust in prices is slow but small then we have creeping inflation. What speed of annual price rise is a creeping one has not been stated by the economists. To some, a creeping or mild inflation is one when annual price rise varies between 2 p.c. and 3 p.c. If a rate of price rise is kept at this level, it is considered to be helpful for economic development. Others argue that if annual price rise goes slightly beyond 3 p.c. mark, still then it is considered to be of no danger.

- Walking Inflation: If the rate of annual price increase lies between 3 p.c. and 4 p.c., then we have a situation of walking inflation.

- Galloping and Hyperinflation: Walking inflation may be converted into running inflation. Running inflation is dangerous. If it is not controlled, it may ultimately be converted to galloping or hyperinflation. It is an extreme form of inflation when an economy gets shattered. “Inflation in the double or triple digit range of 20, 100 or 200 p.c. a year is labeled “galloping inflation”.

- Hyper Inflation: Hyperinflation is when the prices of goods and services rise more than 50 percent a month. It is fortunately very rare. In fact, most examples of hyperinflation have occurred when the government printed money recklessly to pay for war. Examples of hyperinflation include Germany in the 1920s, Zimbabwe in the 2000s, and during the American Civil War.

- Stagflation : Stagflation is when the economy experiences stagnant economic growth, high unemployment, and high inflation. It is unusual because policies to reduce inflation make life difficult for the unemployed, while steps to alleviate unemployment raise inflation.

- Core Inflation : This shows price rise in all goods and services except food and energy due to high prices fluctuations. Oil is a highly volatile commodity, with daily price variations. Food prices change based on gas prices (it heavily reflects on transportation costs), which are directly linked to oil prices. As the government needs a fairly stable and true picture of inflation, core inflation is calculated.

- Headline Inflation : This measure considers total inflation in an economy, including food and energy prices, which are more volatile.

Effects of Inflation

How can Inflation be curbed?

- Monetary Measures

- The governments may take recourse to tighter monetary policy to cool down either the demand-pull or the cost-push inflation. For example, the RBI may increase the bank rates/repo rates. etc to curb the supply of money in the market.

- Because of such a step, the public may want to invest more in the banks and lead to a drop in the consumption, thereby driving down the inflation in the economy.

- It may also use qualitative control methods such as raise margins on loans for commodities for which traders have a tendency to speculate and hoard.

- Reserve Bank may also resort to other operations such as the Open Market Operations to mop out the liquidity from the market by selling government securities and bonds.

- But monetary steps can only be successful if inflation is due to demand pull factors and not structural in nature.

- Some of the limitations of raising interest rates to curb inflation have been discussed below:

- It has been observed several times in the past that the increase in bank rate by the RBI may not translate into a commensurate increase in interest rates by the banks.

- Banks necessarily do not raise their own interest rates at times even if the correct signals have been given by the RBI thereby defeating the entire purpose of the move.

- Another issue, which is important in a country like India, is the large presence of unorganized banking. Because of this RBI is not able to control a large part of the banking sector in the economy.

- Fiscal Measures

- As far as fiscal measures are concerned the government can take two routes to bring down the prices.

- Firstly, it can cut down its own spending on various schemes, projects, etc and secondly it can increase the taxes (either direct or indirect).

- As far as the first option is concerned most of the governments across the world do not employ this method for two simple reasons, first they cannot suddenly reduce the money, which is being spent on several critical projects pertaining to infrastructure, etc as it would not only bring down the image of the country but also create a negative market sentiment.

- Secondly, if they cut down spending on several important welfare schemes, etc then it may politically harm them in the next elections. So cutting down government expenditure is not considered feasible because of a mix of reasons. The second method is raising the taxes to discourage spending.

- The government may increase the private direct taxes to reduce the incomes and thereby decreasing the consumption tendencies among the public.

- It may also increase the indirect taxes on commodities raising their prices and thereby discouraging spending on them by the public.

- Trade Measures

- In case of shortage of goods in domestic market, the supply can be increased through import of goods from foreign countries at low or nill import duty. The higher supply helps to bring down the price.

Also refer :