About the Union Budget

The Union Budget accounts for the government’s finances during the fiscal year from April 1 to March 31. The first Budget in pre-independent India was presented in 1860 by James Wilson of the British Indian Government. After independence, India’s first Budget was presented in 1947 by Finance Minister RK Shanmukham Chetty.

- The Union Budget is presented Annually in accordance with Article 112 of the Indian Constitution. Also called the Annual Financial Statement (AFS) of the Government.

- Demands for Grants (Article 113)

- Finance Bill (Article 110)

- Since 2016 the budget is presented on Feb 01 each year. 2021 marks the first paperless budget.

- Budget preparation: The Department of Economic Affairs, Ministry of Finance, is the nodal body responsible for preparing the Budget document.

- Budget classification: The Union Budget is classified into the Revenue Budget and the Capital Budget.

- Revenue Budget: Encompassing the government’s expected one-year income, including taxes.

- Capital Budget: Addressing government assets and liabilities, focusing on significant expenses like infrastructure development.

- Budget Parts:

- Part A: Macroeconomic section announcing government schemes and priorities.

- Part B: Involves the Finance Bill, containing taxation proposals such as income tax revisions.

Union Budget 2025 Highlights

New Income Tax Regime

- No Tax Up to Rs 12 Lakh: Individuals earning up to Rs 12 lakh annually will not have to pay income tax.

- Tax Relief for Higher Incomes: Those earning Rs 25 lakh will get a benefit of Rs 1.1 lakh under the new regime.

- Revenue Impact: The exemptions will lead to Rs 1 lakh crore in direct tax revenue foregone and Rs 2,600 crore in indirect tax losses.

New Tax Slabs

- Up to Rs 4 lakh – No tax

- Rs 4 lakh – Rs 8 lakh – 5%

- Rs 8 lakh – Rs 12 lakh – 12%

- Rs 12 lakh – Rs 16 lakh – 15%

- Rs 16 lakh – Rs 20 lakh – 20%

- Rs 20 lakh – Rs 24 lakh – 25%

- Above Rs 24 lakh – 30%

Higher tax exemptions, TDS relief, and startup boost in new tax reforms

- Higher Tax Exemption: Under the new income tax regime, there will be no income tax for individuals earning up to Rs 12 lakh annually.

- Relief for Middle-Class Taxpayers: The new tax reform focuses on easing the burden on the middle-income group.

- TDS & TCS Rationalization: The number of TDS rates and thresholds will be reduced to simplify compliance.

- Higher TCS Threshold for LRS: The TCS threshold on remittances under the Liberalized Remittance Scheme (LRS) has been raised from Rs 7 lakh to Rs 10 lakh.

- TDS Relief on Rent: The TDS threshold on rent has been increased to Rs 6 lakh.

- Education Loan Exemption: TCS on education loans up to Rs 10 lakh (from specified financial institutions) will be removed.

- Decriminalization of TCS Delay: Delayed payment of TCS will no longer be treated as a criminal offense.

- More Time for Taxpayers: The time limit to file updated tax returns has been extended from 2 years to 4 years.

- Self-Occupied Property Valuation: Taxpayers can now declare the value of two self-occupied properties as nil.

- International Tax Relief: The scope of safe harbor rules will be expanded to reduce international tax litigation.

- Support for Startups: The period of incorporation for startups to avail of tax benefits has been extended by five years.

Tax reforms and relief for middle-class taxpayers

- TDS Rationalization: The government will rationalize the Tax Deducted at Source (TDS) by reducing the number of rates and thresholds, making the process more taxpayer-friendly.

- Increased TCS Threshold for LRS: The threshold limit for Tax Collected at Source (TCS) on remittances under the Liberalized Remittance Scheme (LRS) has been hiked from Rs 7 lakh to Rs 10 lakh.

- Higher TDS Threshold on Rent: The TDS threshold on rent payments has been raised to Rs 6 lakh, providing relief to individuals and businesses dealing with rental income.

- Exemption on Education Loans: The Budget proposes to remove TCS on education loans up to Rs 10 lakh from specified financial institutions, easing the process for students and their families.

Customs duty and tariff proposals in FY25 Budget

- Seven Tariff Rates to be Removed: Additional to those removed in previous budgets.

- Exemption on Social Welfare Surcharge: 82 tariff lines currently under cess will be exempted.

- 36 Life-Saving Drugs: Added to the list of medicines fully exempt from Basic Customs Duty (BCD).

- Increase in BCD on Flat Panel Displays: From 10% to 20%.

- Exemption on Critical Minerals: 12 more critical minerals will be exempt from BCD.

- Addition of 35 Capital Goods: For EV manufacturing, will be included in the BCD exemption list.

- Customs Duty Reduction: Open-cell customs duty reduced to 5%.

Fiscal Deficit Projections & Market Borrowing

- Fiscal Deficit Projections: FY25 fiscal deficit estimated at 4.8% of GDP, with FY26 target at 4.4%.

- FY26 Tax Receipts: Net tax receipts for FY26 estimated at Rs 28.37 lakh crore.

- Market Borrowing: Gross market borrowing for FY26 projected at Rs 14.82 lakh crore.

- Tariff Adjustments: Proposal to remove 7 tariff rates, in addition to those eliminated in previous budgets.

- Capex for FY25: Revised capital expenditure for FY25 set at Rs 10.18 lakh crore.

Insurance FDI hiked, new income tax bill coming soon & more

- Insurance FDI Limit Raised: Foreign Direct Investment in insurance increased from 74% to 100%.

- New Income Tax Bill: A new income tax bill will be introduced next week.

- Central KYC Registry: Central KYC registry to be rolled out in 2025 for streamlined financial processes.

Key Announcements on Tourism and Innovation

- The top 50 tourism destination sites will be developed in partnership with states to boost tourism across India.

- States will provide land for the development of tourist sites, with a focus on enhancing infrastructure.

- Mudra loans will be made available for homestay businesses to encourage local tourism.

- A focus will be placed on promoting medical tourism and “Heal-in-India” initiatives to attract international patients.

- A deeptech fund-of-funds will be explored to support technological innovation and startups in the sector.

- A National Geospatial Mission will be launched to enhance spatial data and mapping capabilities for better planning and development.

Key Announcements on energy, infrastructure, and regional development

- Aiming for 100 GW of nuclear energy by 2047 to support India’s energy transition.

- A nuclear energy mission will focus on research and development of small modular reactors, with an outlay of Rs 20,000 crore.

- States will be allowed additional borrowing of 0.5% of their Gross State Domestic Product (GSDP) upon implementing select reforms.

- The shipbuilding financial assistance policy will be revamped to boost the industry.

- A maritime development fund with a corpus of ₹25,000 crore will be set up to support the sector.

- The modified Udaan scheme will be launched to connect 120 new destinations across India.

- Financial support will be provided for the development of greenfield airports in Bihar.

- The Western Kosi Canal project in Bihar will also receive financial backing.

Key Announcements on Education, Healthcare, Infrastructure, and Social Welfare

- Broadband connectivity will be provided to all government secondary schools and primary healthcare centres.

- Five National Centers of Excellence for Skilling will be established to boost vocational training.

- Additional infrastructure will be provided for the five IITs established after 2014.

- Three Centres of Excellence in Artificial Intelligence for education will be set up, with a ₹500 crore outlay.

- Day-care cancer centres will be established in every district within three years, with 200 centres planned for 2025-26.

- 10,000 new seats in medical colleges and hospitals will be added in FY26.

- A new social security scheme for gig workers will be launched, providing E-shram portal registration and insurance.

- Each infrastructure-related ministry will draft a three-year plan for implementation in Public-Private Partnership (PPP) mode.

- Rs 1.5 lakh crore in 50-year interest-free loans will be provided to states for capital expenditure (Capex).

- An asset monetisation plan will be launched for the period until FY30.

- FM Nirmala Sitharaman announced in her budget speech an Urban Challenge Fund of Rs 1 lakh crore to implement the proposals for’cities as growth hubs’, ‘creative redevelopment of cities’ and ‘water and sanitation’. The fund that will cover up to 25% of the cost for bankable projects. However, at least 50% of the cost must be funded through bonds, bank loans, or public-private partnerships. A sum of Rs 10,000 crore has been allocated for this initiative in the fiscal year 2025-26.

- Memorandums of Understanding (MoUs) will be signed with states under the Jal Jeevan Mission to boost water supply infrastructure.

Geopolitical Challenges & Global Economic Growth

- Geopolitical headwinds suggest lower global economic growth.

- India’s track record over the past 10 years has drawn global attention.

Agriculture Development Plans

- Agricultural programme targeting 100 districts with low productivity.

- Dhan Dhanya Krishi Yojana to focus on these 100 low-productivity districts.

- The agricultural initiative aims to support 1.7 crore farmers.

Key Agricultural and Fisheries Initiatives in Union Budget 2025

- A national mission to promote high-yielding seeds will be launched.

- A 5-year mission will be launched to boost cotton production in the country.

- An enabling framework for the sustainable harnessing of fisheries in India’s Exclusive Economic Zone (EEZ) will be introduced.

- The loan income under the new Kisan scheme for 7.7 crore farmers will be raised to Rs 5 lakh from Rs 3 lakh

Key Announcements on MSMEs and Industry Initiatives

- India Post will be transformed into a large public logistics organization.

- MSMEs will be the second engine of growth, focusing on 5.7 crore MSMEs.

- Credit guarantee cover for MSMEs will be increased from Rs 10 crore to Rs 20 crore for startups.

- Customised credit cards with a Rs 5 lakh limit will be issued to micro SMEs.

- A new fund-of-funds with Rs 10,000 crore support will be established for startups.

- A new scheme for the footwear and leather sector will generate employment for 22 lakh people and attract investments of Rs 4 lakh crore.

- A scheme will be implemented to position India as a global manufacturing hub for the toys sector.

Announcements on Manufacturing, Infrastructure, and Innovation

- A National Manufacturing Mission will be set up to further strengthen the “Make in India” initiative.

- A new urea plant with a capacity of 1.27 lakh tonnes will be established in Namrup, Assam.

- Efforts will be made to create an ecosystem for solar photovoltaic (PV) cells, electrolysers, and grid-scale batteries.

- 50,000 Atal Tinkering Labs will be set up to foster innovation and creativity.

- Broadband connectivity will be provided to all government secondary schools and primary healthcare centres.

- Five National Centers of Excellence for Skilling will be established to promote vocational training and skill development.

Defence

In the Union Budget 2025, the government has increased defense spending by 7.6%, allocating a total of Rs 4.91 lakh crore for the upcoming financial year.

Focus on Gig economy

- FM Nirmala Sitharaman announced that one crore gig workers will receive ID cards, especially those working with platforms like Swiggy, Zomato, Zepto, and BigBasket.

- The initiative aims to recognize their contributions and extend social security benefits.

- Additionally, these workers will be eligible for healthcare benefits under the PM Jan Arogya Yojana, with registrations facilitated via the e-Shram portal.

- The move aligns with the rapid growth of the quick commerce sector, which has reached a $6 billion market in just four years.

- This development is expected to strengthen social security within the online commerce sector.

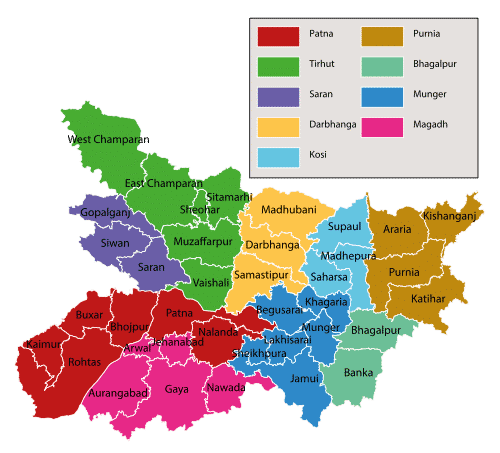

Big push for Bihar

- The FY26 Budget has proposed the creation of a Makhana Board in Bihar to improve the production, processing, value addition, and marketing of makhana. Farmers will be grouped into Farmer Producer Organizations (FPOs) for training and support.

- The government plans to support the development of a new greenfield airport in Bihar to cater to the region’s future aviation requirements.

- Patna’s airport will be expanded to increase its capacity, and a new brownfield airport will be built in Bihar to enhance connectivity.

- Financial backing will be provided for the Western Koshi Canal ERM Project, which will benefit farmers across 50,000 hectares in the Mithilanchal area.

- A National Institute of Food Technology, Entrepreneurship, and Management will be established in Bihar to foster food processing in the eastern region, boosting farmers’ incomes and offering skilling and employment opportunities.

- The Budget also outlined plans to expand hostel and other infrastructure facilities at IIT Patna.

- Poorvodaya initiative projects will focus on the holistic development of eastern India, including Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh.

- FPOs will ensure that makhana farmers are able to take advantage of relevant government programs, helping them with value addition and processing.

- Initiatives, particularly in agriculture and infrastructure, are aimed at increasing farmers’ incomes and in contributing to the overall development of Bihar.

Also refer: