Introduction of MSME Development Act 2006

Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 which was notified on October 2, 2006, deals with the definition of MSMEs. The MSMED Act, 2006 defines the Micro, Small and Medium Enterprises based on

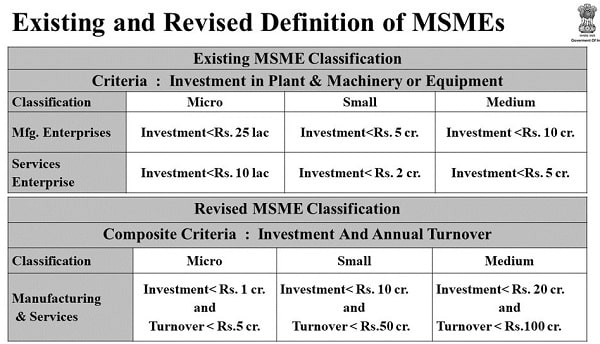

- the investment in plant and machinery for those engaged in manufacturing or production, processing or preservation of goods and

- the investment in equipment for enterprises engaged in providing or rendering of services.

Original Defenition of MSMEs (as per MSMED Act 2006)

The guidelines with regard to investment in plant and machinery or equipment as defined in the MSMED Act, 2006 are:

| Nature of activity of the Enterprise | Investment in plant and machinery excluding land and building for enterprises engaged in manufacturing or production, processing or preservation of goods | Investment in equipment excluding land and building for enterprises engaged in providing or rendering of services (loans up to Rs 1 crore) |

| Micro | Not exceeding Rs.25.00 Lakhs | Not exceeding Rs.10.00 Lakhs |

| Small | More than Rs.25.00 lakhs but does not exceed Rs.500.00 lakhs | More than Rs.10.00 lakhs but does not exceed Rs.200.00 lakhs |

| Medium | More than Rs.500.00 lakhs but does not exceed Rs.1000.00 lakhs | More than Rs.200.00 lakhs but does not exceed Rs.500.00 lakhs |

New Defenition of MSMEs

- As per the new definition of MSMEs announced in May 2020, the investment limit has been revised upwards and an additional criterion of turnover introduced.

- The distinction between manufacturing and services has been done away with.

- Now, a micro firm is one with investment up to Rs 1 crore and turnover less than Rs 5 crore, the small firm has investment up to Rs 10 crore and turnover up to Rs 50 crore and medium-firm will be one with an investment of up to Rs 20 crore and turnover under Rs 100 crore.

Micro, Small and Medium Enterprises Classification 2020

| Size of the Enterprise | Investment and Annual Turnover |

| Micro | Investment less than Rs. 1 crore & Turnover less than Rs. 5 crore |

| Small | Investment less than Rs. 10 crore & Turnover up to Rs. 50 crore |

| Medium | Investment less than Rs. 20 crore & Turnover up to Rs. 100 crore |

Benefits provided to MSMEs

- Loans under the priority sector lending scheme.

- 25% share in procurement by government and government-owned companies.

- Promoters are allowed to bid for stressed assets under the insolvency law (unlike big companies).

- Various government schemes and funds.

Share of MSMEs in India

Currently, around 6.5 crore micro, small and medium enterprises (MSMEs) contribute 30 per cent to GDP. The government aims to increase the MSME sector’s share in the GDP to 40 per cent to benefit the rural poor.

importance of MSMEs for Indian Economy

Employment creator:

- MSME is 2nd largest employment provider after agriculture sector.

- It provides 80% of jobs in the industry with just 20% of the investment.

- They also check rural-urban migration by providing people living in isolated areas with a sustainable source of employment.

Economic growth and exports:

- It contributes about 30% to the nation’s GDP, 45% share in the overall exports and 34% share in the manufacturing output as per the 2017 report.

- Non-traditional products like sports goods, readymade garments etc. account for more than 95% of the MSME exports. As these products are mostly handcrafted and hence eco-friendly, there exists an enormous potential to expand MSME led exports.

- Moreover, MSMEs act as ancillary industries for large-scale industries since they provide the latter with raw materials, important components etc.

Inclusive growth:

- MSMEs drive inclusive growth since it develops the lives of the most vulnerable and marginalized sections in India who are the majority of MSME owners.

- Thus MSME sector empowers people by breaking the cycle of poverty and deprivation.

- It is also because the MSME sector in India mostly depends on people’s skills rather than their wealth or capital.

Challenges faced by the MSME sector

- Lack of scaling up and expansion or confined to the rural area.

- Access to capital: Around 40% of the small enterprises depends on the informal sources of credit or loan.

- Lack of latest techs : Hence, less productivity and less competitive compared to imported products and services.

- Deficiencies in basic infrastructural facilities: such as water, electricity, road or rail and telephone connectivity etc.

- Bureaucratic red tape: difficulties in getting multiple statutory clearances with respect to electricity, environment, labour etc.

- Lack of skilled labour

- Raw material availability

The Twelfth Plan has listed the following as the objectives for the MSME sector

- Promoting competitiveness and productivity in the MSME space.

- Making the MSME sector innovative, improving technology and depth.

- Enabling environment for the promotion and development of MSMEs.

- Strong presence in exports.

- Improved managerial processes in MSMEs.

Measures Taken By The Government

In order to promote the Ease of Doing Business, the Ministry of Micro, Small and Medium Enterprises (MSME) has introduced various initiatives including online filing of UdyogAadhaar Memorandum (UAM). The Ministry has also taken the following steps:

- MSME SAMADHAAN Portal- for empowering micro and small entrepreneurs across the country to directly register their cases relating to delayed payments.

- MSME SAMBANDH Portal- to help in monitoring the implementation of public procurement policy for micro and small enterprises.

- MSME SAMPARK Portal – A digital platform wherein jobseekers (passed out trainees/students of MSME Technology Centres) and recruiters get connected.

- Digital Payments- to pass on the benefits of the schemes of Ministry of MSME through digital payment gateway.

MSME Samadhaan

MSME Samadhaan is an online portal where MSMEs can file their applications online regarding delayed payments.

- The application can be made by the supplier MSE unit against the buyer of goods/services before the concerned Micro & Small Enterprises Facilitation Council (MSEFC) of his/her state or union territory.

- The portal has been developed by the Ministry of MSME. However, it does not take action on the applications filed on the MSME Samadhaan portal directly. It only forwards these applications to the concerned MSEFC. It is the MSEFC that takes appropriate action in this regard. The MSEFC will also consider physical applications and a portal is only an option.

- To file on the MSME Samadhaan portal, it is mandatory for the business to have a Udyog Aadhar Memorandum.

- The enterprise should also keep a record of all formal purchase orders from customers and delivery proofs for all orders.

- The issue of delayed payments to MSME was addressed in the Micro, Small and Medium Enterprise Development (MSMED) Act, 2006.

MSME Sambandh

The Ministry of Micro, Small and Medium Enterprises (MSME) launched Public Procurement Portal ‘MSME Sambandh’ for Public Procurement Portal for MSMEs.

The objective of the portal is to monitor the implementation of the Public Procurement from MSEs by Central Public Sector Enterprises (CPSEs). It will help MSMEs in participating in the procurement process. Besides, it will help Ministries and the CPSEs can assess their performance in procurement process as stipulated in Procurement Policy, 2012.

MSME SAMPARK Portal

The MSME Sampark portal is a digital platform, wherein, job seekers (passed out trainees / students of 18 MSME Technology Centers) and recruiters register themselves for getting employment and getting right kind of manpower respectively.

Udyam Registration Portal

zero-cost Micro, Small and Medium Enterprises (MSME) registration portal by the name Udyam Registration. This portal is a self-declaration and cost-free platform for small or medium entrepreneurs to get their enterprises registered.

This Udyam portal is merged with the Income Tax and Goods and Services Tax Identification Number (GSTIN) systems that can automatically pull PAN and GST-linked investment details. Also, the MSME Udyam portal is a simple and one-time process that can be done through Udyam portal and single window systems.

Earlier MSME registrations were done under Udyog Aadhar Memorandum (UAM) on the e-filing system. The UAM has now been replaced by Udyam Registration.

MSME Databank Portal:

- It aims to gather information about micro, small and medium enterprise (MSMEs).

- Its Objective is to have one-stop source of information of MSMEs of India, including their credit and technology, requirement in terms of raw material and marketing, etc.

- It will enable the MSME units and the various Associations to furnish data online. It will save the efforts and money required for physical Census.

- Databank’s MIS dashboard will provide real time information on various types of the MSMEs registered on the portal.

- The databank will be used for public procurement purposes and the PSUs will make use of the data for procuring from MSMEs.

Important Schemes of MSME

SFURTI Scheme

- It is an initiative by Ministry of MSME to promote Cluster development.

- The Khadi and Village Industries Commission (KVIC) is the nodal Agency for promotion of Cluster development for Khadi.

- Significance of SFURTI Scheme

- Its primary objective is to organise traditional industries and artisans into clusters to make them competitive and increase their income.

- It provides support for creating infrastructure through Common Facility Centres, procurement of new machineries, creating raw material banks and improved packaging.

ASPIRE Scheme

- ASPIRE Scheme or Scheme for promotion of innovation, entrepreneurship and Agro-Industry is promoted by the Ministry of Micro, Small and Medium Enterprises.

- It will promote Innovation & Rural Entrepreneurship through rural Livelihood Business Incubator (LBI), Technology Business Incubator (TBI) and Fund of Funds for start-up creation in the agro-based industry.

- The ASPIRE Scheme fund has a Rs.200 crore corpus

Prime Minister’s Employment Generation Programme

- The scheme was launched in 2008.

- It is a flagship scheme of the Ministry of MSME.

- It is a credit-linked subsidy scheme which promotes self-employment through setting up of micro-enterprises, where subsidy up to 35% is provided by the Government through Ministry of MSME for loans up to ₹25 lakhs in manufacturing and ₹10 lakhs in the service sector.

- The balance amount of the total project cost will be provided by the banks in the form of term loan and working capital.

- Individuals above the age of 18 years, Self Help Groups (SHGs), Cooperative Societies involved in the production, and institutions that are registered under the Societies Registration Act of 1860 are eligible for benefits under this programme.

- Implementation:

- National Level- Khadi and Village Industries Commission (KVIC) as the nodal agency.

- State Level- State KVIC Directorates, State Khadi and Village Industries Boards (KVIBs), District Industries Centres (DICs) and banks.

Entrepreneurship Skill Development Programme (ESDP)

- The objective of the programme is to motivate youth representing different sections of the society including SC/ST/Women, differently-abled, Ex-servicemen and BPL persons to consider self employment or entrepreneurship as one of the career options.

- The programe includes the following :-

- Industrial Motivation Campaigns (IMCs)

- Entrepreneurship Awareness Programmes (EAPs)

- Entrepreneurship-cum-Skill Development Programme (E-SDP)

- Management Development Programmes (MDPs)

Important schemes of MSME for exams are given above. If you want to know more about MSME schemes then go through the given below link :

Also refer :