The fundamental difference between the different kinds of economic recovery is the time taken for economic activity to normalize. In this article, let’s try to take a brief look how K, L, V, U, W & Z Shaped economic recovery compare.

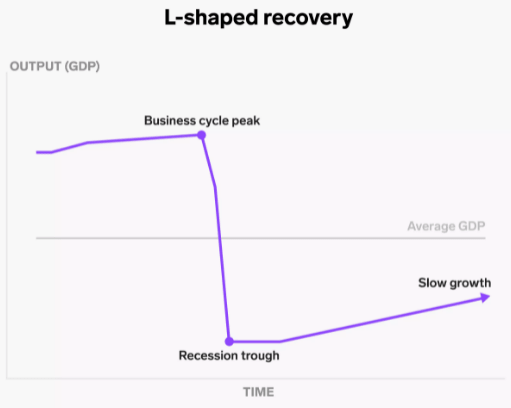

L–shaped Economic recovery

An L–shaped recovery is a type of recovery characterized by a slow rate of recovery, with persistent unemployment and stagnant economic growth.

- The L-shaped recovery has the lengthiest recession period of all – so long, in fact, it’s sometimes dubbed a depression.

- After a sharp decline, GDP begins to increase, but recovery is very gradual and lengthy.

- It can take years for the economy to get back to where it was pre-downturn, and in some cases, this slow revival drags on indefinitely.

Some economists characterize the Great Recession as an L-shaped recovery. Although it technically lasted only from 2007-09, as measured by GDP, many other key economic indicators didn’t reach their pre-recession levels for four to six years.

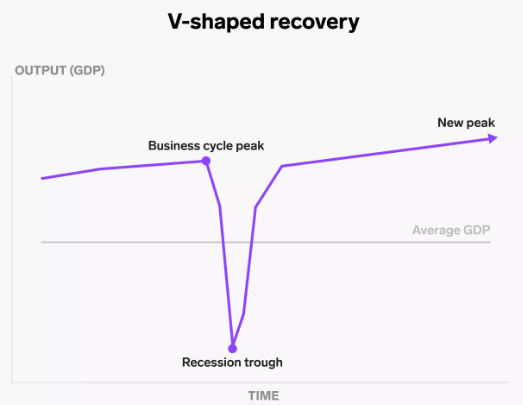

V–shaped Economic Recovery

In a V-shaped recovery, the economy experiences a sharp decline but then bounces back almost immediately to its pre-recession level.

- This can occur when the economic interruption that caused a recession doesn’t last long.

- It could be a seasonal slowdown when consumers are temporarily out of work but employers are holding those jobs for them. Or could be that swift and appropriate monetary and fiscal policies successfully mitigate the impact of the recession.

Example – The Recession of 1953

- The recession of 1953 in the United States is another clear example of a V-shaped recovery.

- This recession was relatively brief, and mild with only a 2.2% decline in GDP and unemployment rate of 6.1%.

- Growth began to slow in the third quarter of 1953, but by the fourth quarter of 1954 was back at a pace well above the trend.

- Therefore, the chart for this recession and recovery would represent a V-shape.

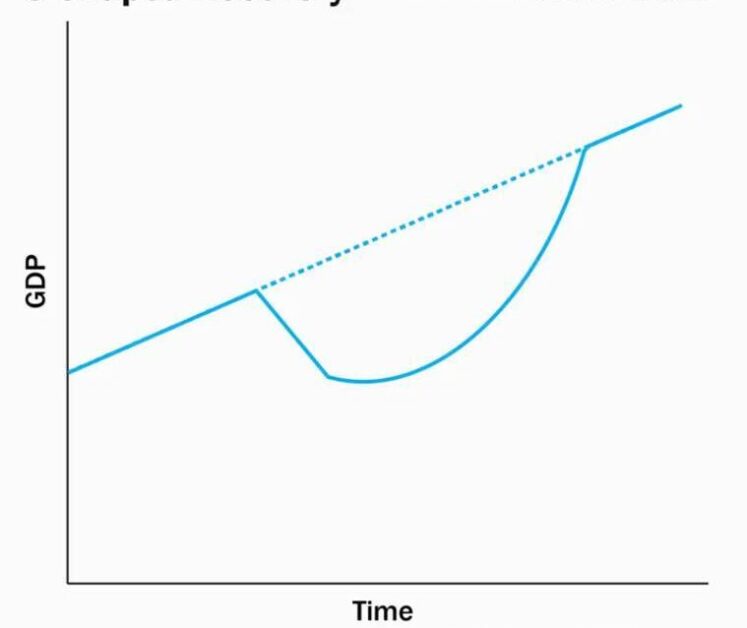

U–shaped economic recovery

A U–shaped recovery describes a type of economic recession and recovery that charts a U shape, established when certain metrics, such as employment, GDP, and industrial output sharply decline and then remain depressed typically over a period of 12 to 24 months before they bounce back again.

- Less ideal than a V-shaped recovery but still far from a worst-case scenario, the U-shaped recovery is one in which the economy declines and then spends a significant period of time at the trough before improving.

- This doesn’t necessarily mean that the recession is more severe in terms of the loss in GDP, but it does mean that it lasts longer.

- The 1973-1975 recession, in which the economy didn’t resume pre-recession levels until 1976, is a clear example of a U-shaped recovery.

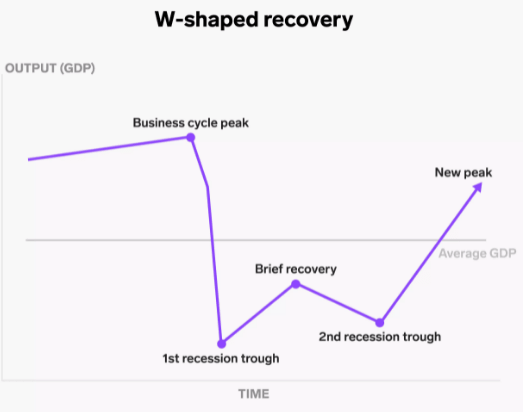

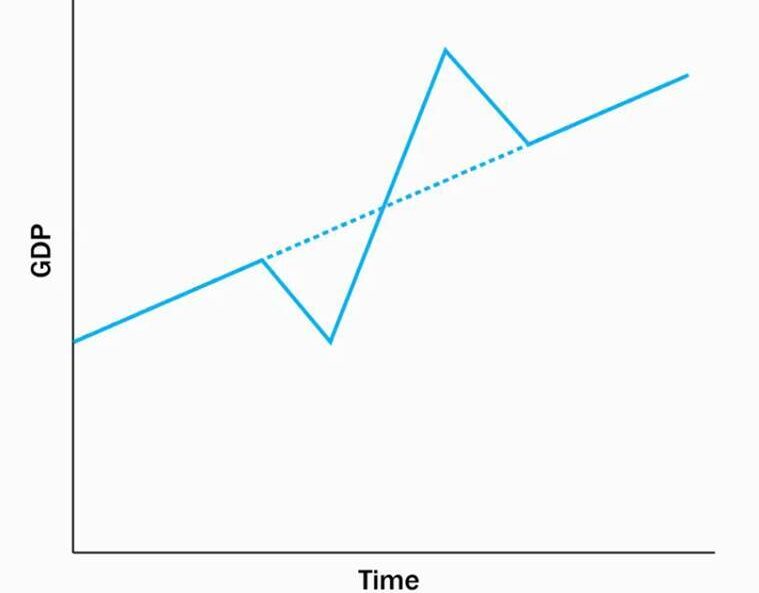

W-shaped Economic Recovery

A W-shaped recovery, also known as a double-dip recession, is one in which there’s a brief economic comeback – sometimes tricking people into thinking they’ll get a V-shaped recovery – but then the economy falls a second time. It’s essentially two recessions in one, which prolongs the impact of the first and can shatter consumer confidence.

Example – US economy in 1980’s

The United States experienced a W-shaped recovery in the early 1980s. From January to July 1980 the U.S. economy experienced the initial recession, and then entered recovery for almost a full year before dropping into a second recession in 1981 to 1982.

Z-shaped Economic Recovery

For instance, if the economic disruption was just for a small period wherein more than people’s incomes, it was their ability to spend that was restricted, then when the lockdown opened, it is possible to imagine a “Z”-shaped recovery .

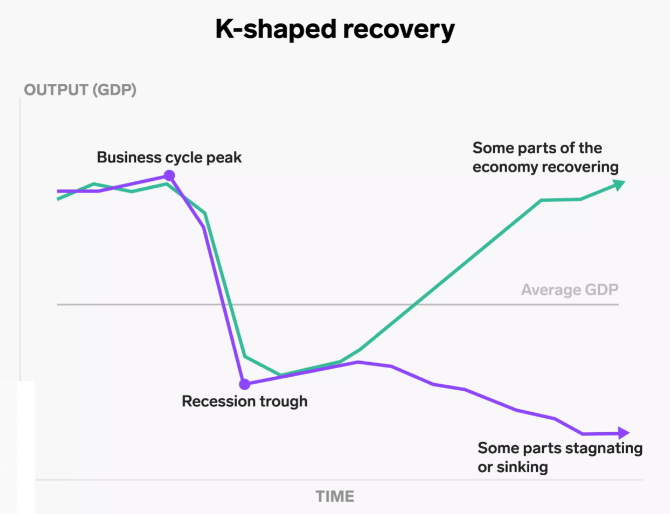

K-shaped Recovery

The K-shaped recovery is a bit different from the others. It’s a relatively new term created to describe what economists see happening with the COVID-19 pandemic.

In this situation, one segment of the economy trends upward – experiencing more of a V-shaped or U-shaped recovery – while another segment either sinks further or recovers much more slowly, like with the L-shaped recovery. This divergence between two different economic groups is depicted by the two diagonal lines in the letter K.

- The affected groups are both industries and individuals. Some industries have been able to continue operating or have even thrived during the pandemic (i.e., high-tech and e-commerce) while others have suffered a major slowdown or been virtually unable to function (i.e., travel and hospitality, arts and entertainment).

- Similarly, individuals have been affected along class, generational, and racial lines.

- The recession didn’t necessarily cause these disparities. But the K-shaped recovery has certainly uncovered, and in some cases, greatly exacerbated, the already existing inequalities.

How do the recoveries compare?

- The V-shaped and U-shaped recoveries are the most common, although the other shapes are far from unheard of.

- A V-shaped recovery is the best-case scenario thanks to the short period of time spent in the recession’s trough, while an L-shape is the worst-case scenario because it has the most prolonged recovery.

- While these letters describe the duration and nature of economic recovery, they don’t describe the severity of the recession that preceded it. For example, a recession in which GDP falls 1% and the recovery takes a U-shape might be preferable to one in which GDP falls 4% but takes a V-shape.

The financial takeaway

When you’re still in the middle of a recession, it’s impossible to know for certain what shape economic recovery will take. However, once key economic indicators such as GDP, employment, and inflation (price increases, due to growing demand) begin to respond, economists can offer up educated predictions on what the future might hold for investors and consumers alike.

Having an idea of whether the economy might jump back up soon or dip down a second time can offer some guidance on financial decisions. You wouldn’t want to pull your investments right before the economy rises again, in the second line of the V-shaped recovery. On the other hand, an impending decline, like the second phase of the W-shape, might signal that you should store safely some extra away in your savings account.

If a recovery seems to be sluggish, e.g. in the U or L-shaped, it might be a signal to convert some growth-oriented investments into income-producing ones, in case you’re in need of cash.

Source : Indian Express, Business insider

Also refer : Economic reforms in India.