What is Social Security?

According to ILO, Social security is the protection that a society provides to individuals and households to ensure access to health care and to guarantee income security, particularly in cases of old age, unemployment, sickness, invalidity, work injury, maternity, etc.

According to the latest report (World Social Protection Report 2020-22: Regional companion report for Asia and the Pacific) on social protection by the International Labour Organisation (ILO), only 24.4% of Indians, even fewer than Bangladesh (28.4%), are under any sort of social protection benefit.

Important Social Security Schemes in India

Atal Pension Yojana (APY): Social Security Schemes

- It was launched on May 9, 2015.

- Atal Pension Yojana (APY) is open to all bank account holders.

- The scheme is available to any citizen of India with Ages 18-40 Years.

- The subscribers would receive the fixed minimum pension of Rs. 1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, and Rs. 5000 per month, at the age of 60 years.

- Under APY, the monthly pension would be available to the subscriber, and after him to his spouse, and after their death, the pension corpus, as accumulated at age 60 of the subscriber, would be returned to the nominee of the subscriber.

Pradhan Mantri Suraksha Bima Yojana (PMSBY): Social Security Schemes

It was launched on May 9, 2015. The scheme will be a one-year cover, renewable from year to year; Accident Insurance Scheme offers accidental death and disability cover for death or disability on account of an accident.

- All savings bank account holders in the aged 18 to 70 years in participating banks will be entitled to join.

- The cover shall be for the one year period stretching from 1st June to 31st May.

- The premium of Rs. 20 will be deducted from the account holder’s savings bank account for which option to join / pay by auto-debit from the designated savings bank account by 31st May of every year subject to availability of the fund in the Bank’s account.

Pradhanmatri Jeevan Jyoti Bima Yojana (PMJJBY): Social Security Schemes

It was launched on May 9, 2015. The scheme will be a one year cover, renewable from year to year, Insurance Scheme offering life insurance cover for death due to any reason.

- All savings bank account holders in the age 18 to 50 years in participating banks will be entitled to join.

- Subscriber will get insurance cover of Rs. 200000/- on receipt of premium by Insurance Company.

- A 30 Days lien clause may be imposed in PMJJBY scheme whereby the claim cases during the first 30 days from the date of enrollment will not be paid. However deaths due to accident would be exempted from the lien clause.

- The premium of Rs 436/- will be deducted from the account holder’s savings bank account through ‘auto debit’ facility in one installment, as per the option given, on or before 31st May of each annual coverage period under the scheme subject to availability of the fund in the Bank’s account.

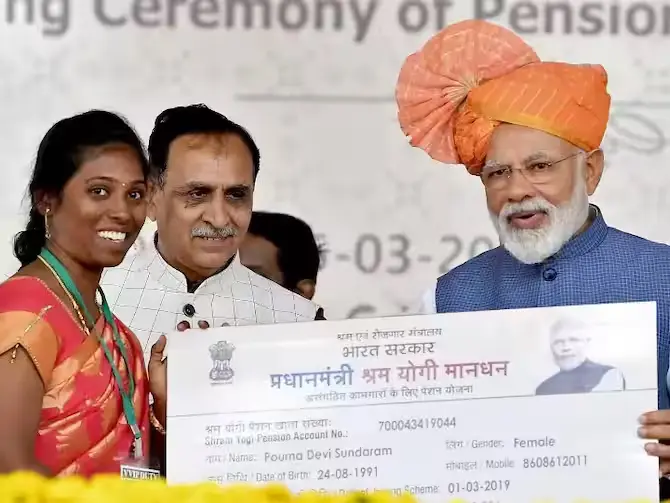

Pradhan Mantri Shram Yogi Maan-Dhan Yojana (PM-SYM) (Old Age Protection): Social Security Schemes

- In order to provide old age protection, the Government of India launched PradhanMantriShram Yogi MaanDhan (PM-SYM) pension scheme in 2019.

- Monthly contribution ranges from Rs.55 to Rs.200 depending upon the entry age of the beneficiary.

- Under this schemes, 50% monthly contribution is payable by the beneficiary and equal matching contribution is paid by the Central Government.

- It provides monthly pension of Rs. 3000/- after attaining the age of 60 years.

- Under the scheme, the funds towards Government’s contribution are provided to LIC being the fund manager.

Eligibility

- Should be an Indian Citizen

- Unorganised Workers (working as street vendors, agriculture related work, construction site workers, workers in industries of leather, handloom, mid-day meal, rickshaw or auto wheelers, rag picking, carpenters, fisherman’s etc.

- Age group of 18-40 years

- Monthly income is below Rs.15000 and not a member of EPFO/ESIC/NPS (Govt. funded).

Benefits

- After attaining the age of 60 yrs, beneficiaries are entitled to receive minimum monthly assured pension of Rs.3000/-.

- On death of the beneficiary, spouse is eligible for 50% monthly pension.

- If husband and wife, both joins the scheme, they are eligible for Rs. 6000/- monthly pension jointly.

National Pension Scheme for Traders and The Self-employed Persons (NPS): Social Security Schemes

- Voluntary and contributory pension schemes

- Monthly contribution ranges from Rs.55 to Rs.200 depending upon the entry age of the beneficiary.

- Under this schemes, 50% monthly contribution is payable by the beneficiary and equal matching contribution is paid by the Central Government.

Eligibility

- Should be an Indian Citizen

- Shopkeepers or owners who have petty or small shops, restaurants, hotels, real estate brokers etc.

- Age of 18-40 years

- Not covered in EPFO/ESIC/PM-SYM

- Annual turnover not more then 1.5 Crore in rupees

Benefits

- Under the schemes, beneficiaries are entitled to receive minimum monthly assured pension of Rs.3000/- after attaining the age of 60 years.

PDS: Social Security Schemes

Eligibility

- Should be an Indian citizen

- All families below the poverty line is eligible.

- Any family which does not have a member between ages 15 and 59 years of age.

- Any family which has a disabled member is also eligible to avail of benefits under Pradhan Mantri Awas Gramin Yojana

- Those who do not have a permanent job and only engage in casual labour.

Benefits

- 35 kg of rice or wheat every month, while a household above the poverty line is entitled to 15 kg of food grain on a monthly basis.

- Being implemented as ONORC to enable migrant workers to receive the food grains wherever they are working.

Pradhan Mantri Awaas Yojana – Gramin (PMAY-G): Social Security Schemes

Eligibility

- Should be an Indian citizen

- Any family including workers, which does not have a member between ages 15 and 59 years of age.

- Any family which has a disabled member is also eligible to avail of benefits under Pradhan Mantri Awas Gramin Yojana

- Those who do not have a permanent job and only engaged in casual labour.

Benefits

- Assistance provided to the Beneficiary to the tune of 1.2 Lakhs in plain areas and 1.3 Lakhs in Hilly Areas.

National Social Assistance Programme (NSAP) -Old age Protection: Social Security Schemes

Eligibility

- Should be an Indian citizen

- Any person who has little or no regular means of subsistence from his/her own source of income or through financial support from family members or other sources.

Benefits

- Central Contribution @ Rs 300 to Rs 500 for different age group.

- Monthly pension ranges from Rs 1000 to rs 3000/ depending upon state’s contribution.

Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (AB-PMJAY): Social Security Schemes

Eligibility

- Those living in scheduled caste and scheduled tribe households.

- Families with no male member aged 16 to 59 years.

- Beggars and those surviving on alms

Benefits

- Health coverage of Rs. 5 lakhs per family per year for secondary and tertiary care hospitalization free of cost.

Health Insurance Scheme for Weavers (HIS): Social Security Schemes

Eligibility

- Should be an Indian Citizen

- The weaver should be earning at least 50% of his income from handloom weaving

- All weavers, whether male or female, are eligible to be covered under the “Health Insurance Scheme”

Benefits

- The beneficiaries would avail a package of Rs 15,000 that includes both pre-existing diseases and new diseases.

- The division in terms of disbursement of the amount according to the medical conditions stands as- Maternity benefits (per child for the first two)- Rs 2500, Eye treatment – Rs 75, Spectacles – Rs 250, Domiciliary Hospitalisation- Rs 4000, Ayurvedic/Unnani/Homeopathic/Siddha- Rs 4000, Hospitalization (including pre and post)- Rs 15000, Baby coverage-500, OPD and limit per illness- Rs 7500.

Pradhan Mantri Kisan Mandhan Yojana: Social Security Schemes

Eligibility

- Should be an Indian Citizen

- For Small and Marginal Farmers

- Entry Age between 18 to 40 years

- Cultivable land up to 2 hectares as per land records of the concerned State/UT

Benefits

- Assured pension of Rs. 3000/- month

- Voluntary and Contributory Pension Scheme

- Matching Contribution by the Government of India.

National Safai Karamcharis Finance and Development Corporation (NSKFDC): Social Security Schemes

Eligibility

- Should be an Indian Citizen

- People involved as Safai karmacharis and manual scavengers

Benefits

- Scheme provides financial assistance to the Safai Karamcharis, Manual Scavengers and their dependants through SCAs/RRBs/Nationalized Banks for any viable income generating schemes including sanitation related activities and for education in India and Abroad.

Self Employment Scheme for Rehabilitation of Manual Scavengers: Social Security Schemes

Eligibility

- Should be an Indian Citizen

- Identified manual scavengers, one from each family, (as defined in para 2.3.1) would be eligible for One Time Cash Assistance (OTCA) of Rs. 40,000/- or any such amount as OTCA as revised from time to time.

Benefits

- The manual scavenger and the dependents (as defined in para 2.3.2) shall be provided, free of cost, skill training of their choice from the list of such trainings organized by the National Safai Karmacharis Finance and Development Corporation (NSKFDC) from time to time . A monthly stipend of Rs. 3000/-(Rupees three thousand only) or any such amount as may be decided from time to time to shall be remitted by NSKFDC.

Life Cover under Pradhan Mantri Jan Dhan Yojana (PMJDY): Social Security Schemes

The Hon’ble Prime Minister in his Independence Day Speech announced a comprehensive program of Financial Inclusion targeting a large number of people who are currently deprived of even rudimentary financial services. In this direction, the Pradhan Mantri Jan DhanYojana (PMJDY) sets out to provide a basic Bank account to every family who till now had no account.

The bank account comes with a RuPay debit card with a built-in accidental insurance cover of Rs. 1 lakh. During the launch on 28.08.14 in New Delhi, Hon’ble Prime Minister also announced a life cover of Rs. 30,000/- for those subscribing to a bank account with a RuPay debit card before 26th January, 2015 to complement the Rs. 1 lakh accident insurance cover.

This life insurance cover of Rs. 30,000/- under Pradhan Mantri Jan DhanYojana, gives life insurance cover on death of the life assured, due to any reason, to the deceased’s family. The scheme aims to provide security to families from economically weaker sections who cannot afford direct purchase of such insurance. The premium subscription for the life cover under PMJDY is borne by the Government of India.

Varishtha Pension Bima Yojana: Social Security Schemes

The NDA Government during its last term in office had introduced the Varishtha Pension BimaYojana (VPBY) as a pension scheme for senior citizens.

- Under the scheme a total no. of 3.16 lakh annuitants are being benefited and the corpus amounts to Rs. 6,095 crore.

- For the benefit of citizens aged 60 years and above, the Hon’ble Finance Minister in his Budget Speech for the year 2014-15 proposed to revive the scheme for a limited period from 15 August, 2014 to 14 August, 2015.

- Accordingly, the revived Varishtha Pension BimaYojana (VPBY) was formally launched by the Finance Minister on 14.08.2014 and has been opened during the window stretching from 15th August, 2014 to 14th August, 2015.

- Thus all those who subscribe to the VPBY during this period will receive an assured guaranteed return of 9% under the policy.

- The scheme is administered through Life Insurance Corporation of India (LIC). Under the Scheme the subscribers on payment of a lump sum amount get pension at a guaranteed rate of 9% per annum (payable monthly).

- Any gap in the guaranteed return over the return generated by the LIC on the fund is compensated by Government of India by way of subsidy payment in the scheme.

- The scheme allows withdrawals of deposit amount by the annuitant after fifteen years of purchase of the policy.

Pradhan Mantri Vaya Vandana Yojana(PMVVY): Social Security Schemes

Based on the success and popularity of Varishtha Pension Bima Yojana 2003 (VPBY-2003), Varishtha Pension Bima Yojana 2014 (VPBY-2014) schemes, and to protect elderly persons aged 60 years and above against a future fall in their interest income due to the uncertain market conditions, as also to provide social security during old age, it is decided to launch a simplified scheme of assured pension of 8% called the ‘प्रधानमंत्रीवयवन्दनायोजना’. ‘प्रधानमंत्रीवयवन्दनायोजना’ is being implemented through Life Insurance Corporation (LIC) of India.

As per the scheme, on payment of an initial lump sum amount ranging from a minimum purchase price of Rs. 1, 50,000/- for a minimum pension of Rs 1000/- per month to a maximum purchase price of Rs. 7, 50,000/- for maximum pension of Rs. 5,000/- per month, subscribers will get an assured pension based on a guaranteed rate of return of 8% per annum, payable monthly.

Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (AB-PMJAY): Social Security Schemes

- The Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) provides an annual health cover of Rs. 5 lakhs per eligible family for secondary and tertiary care hospitalization corresponding to 1949 treatment procedures across 27 specialties.

- It is a completely cashless and paperless scheme.

- The beneficiary families under AB-PMJAY have been identified from Social Economic Caste Census (SECC) of 2011 basis 6 deprivation and 11 occupational criteria across rural and urban areas.

Pradhan Mantri Fasal Bima Yojana(PMFBY): Social Security Schemes

The Pradhan Mantri Fasal Bima Yojna was launched on 18th February 2016 by Prime Minister Shri Narendra Modi.

- PMFBY provides a comprehensive insurance cover against failure of the crop thus helping in stabilising the income of the farmers.

- The Scheme covers all Food & Oilseeds crops and Annual Commercial/Horticultural Crops for which past yield data is available and for which requisite number of Crop Cutting Experiments (CCEs) are conductedbeing under General Crop Estimation Survey (GCES).

- The scheme is implemented by empanelled general insurance companies. Selection of Implementing Agency (IA) is done by the concerned State Government through bidding.

- The scheme is compulsory for loanee farmers availing Crop Loan /KCC account for notified crops and voluntary for other others.

- The scheme is being administered by Ministry of Agriculture.

What is International Labour Organisation (ILO)?

- It is the only tripartite United Nation (UN) agency. It brings together governments, employers and workers of 187 member States (India is a member), to set labour standards, develop policies and devise programmes promoting decent work for all women and men.

- Received the Nobel Peace Prize in 1969.

- Established in 1919 by the Treaty of Versailles as an affiliated agency of the League of Nations.

- Became the first affiliated specialized agency of the UN in 1946.

- Headquarters: Geneva, Switzerland.

Also, refer :