Introduction

In India, the system of direct taxation as it is known today, has been in force in one form or another even from ancient times. Present Indian tax system is based on ancient tax system which was based on the theory of maximum social welfare. As Kalidas described in Raghuvansham eulogizing king Dalip- “It was only for the good of his subjects that he collected taxes from them, just as the Sun draws moisture from the Earth to give it back a thousand fold”.

Important Types of Taxation in Ancient India

- Sita : profits from Stand land

- Bali : religious taxes

- Kara : taxes paid in cash

- Bhaga : share or portion of the produce payable to the state

- Booty : Gains of victory in the form of wealth of the losing nation comprised the prime source of public finance

- Vanikpath was the income from roads and traffic paid as tolls

- Vartanam : levy on all foreign commodities imported in the country

- Dvarodaya : levy paid by the concerned businessman for the import of foreign goods

- yatravetana : levied on pilgrims

There are references both in Manu Smriti and Arthasastra to a variety of tax measures. Manu laid down that traders and artisans should pay 1/5th of their profits in silver and gold, while the agriculturists were to pay 1/6th, 1/8th and 1/10th of their produce depending upon their circumstances. Taxes were paid in the shape of gold-coins, cattle, grains, raw-materials and also by rendering personal service.

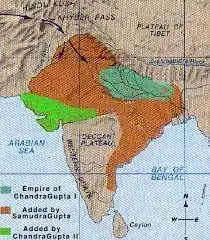

Kautilya emphasised that the King was only a trustee of the land and his duty was to protect it and to make it more and more productive so that land revenue could be collected as a principal source of income for the State. According to him, tax was not a compulsory contribution to be made by the subject to the State but the relationship was based on Dharma and it was the King’s sacred duty to protect its citizens in view of the tax collected and if the King failed in his duty, the subject had a right to stop paying taxes, and even to demand refund of the taxes paid.

According to the Arthasastra, the land revenue was fixed at 1/6 share of the produce and import and export duties were determined on advalorem basis. The import duties on foreign goods were roughly 20 per cent of their value. Similarly, tolls, road cess, ferry charges and other levies were all fixed. Kautilya’s concept of taxation is more or less akin to the modern system of taxation. His over all emphasis was on equity and justice in taxation. All kinds of liquor were subject to a toll of 5 precent. Tax evaders and other offenders were fined to the tune of 600 panas.

Important Types of Taxation in Medieval India

- Ghari was a tax on houses. It was introduced by Allauddin Khilji.

- Charah was a tax on grasslands used for grazing of animals. It was also introduced by Allauddin Khilji.

- Kharaz was a tax levied on the gross product of lands belonging to non-Muslims. It was introduced by Firoz Shah Tughlaq.

- Ushraf was a tax levied on the gross product of lands belonging to Muslims.

- Zakat was a religious tax levied on Muslims. It was kept in the special treasury of Diwan-i-Rasalat headed by kabir-i-Mulk.

- Jizya was a tax levied on non-Muslims and non-followers of Islam.

- Khums was a tax which was 1⁄5 of the product (20%) if a person’s earnings exceeded the expenditure needed for them and their family.

- Sharab or Sharb was 1⁄10 of crop production levied on farmers to develop and maintain water supply facilities. It was introduced by Firuz Tughlaq.

- In the Vijayanagara Empire, the government department responsible collecting the land revenue was called Athanave. The Vijayanagara emperors collected the taxes based on the soil fertility of lands. Tax on production was 1⁄6 of the gross product. It was paid either in the form of crops or money. Heavy taxes were levied on prostitution.

- Turkic sultans followed the Hanafi School of Islamic jurisprudence as their monetary policy. The costs were very low in the time of Ibrahim Lodhi. In the Vijayanagar Empire the cost of goods was also low.

- Zarib was introduced by Murshid Quli Khan based on the unit bigha. It was collected as one quarter of the crop production. It was paid in any form.

Sultanate Period

- The two major institutions were popular during the time of sultanate, one of them was- the iqta which was a transferable territorial tax- assignment and military charges. The other was a tax on land was major source of revenue for state in sultanate period which called kharaj. It was levied at the rate of 1/5 th share of total produce during the reign of Ala-Ud-Din Khilzi which was further increased to ½ of the produce in the time of Muhammad Tughlak. The sultanate also demanded fawazil, which was any surplus revenue into royal treasury. Instead of this sultans had a khalisa– a certain areas which were under direct control of sultans.

- One of the different kind of tax known as Zazia was imposed in medieval India which was paid by NonMuslims. Its rate was varied according to tax payer’s income.

Mughal Period

- Taxation in Mughal period was systemized, but there was no universal tax system. Although even at that time the land tax was a central fact of Indian economy. It was ½ of the total produce.

- The land tax was known as mal or kharaj which was set as a portion of crop after harvest. Ghalla-bakhshi, kankut and jabt system was evolved for land revenue assessment.

- Ghalla-bakhshi was a system of crop-sharing. In some areas it was called bhaoli and batai.

- Kankut or dambandi was a system where the grain yield was estimated. In Kankut, at first instances the field was measured after that revenue demand was fixed accordingly the productivity of per bigha as estimated.

- Sher Shah established a standard crop yield system known as Rai. Rai was levied on per bigh yield for lands which were under continuous cultivation. This system of Sher Shah is followed by Akbar reign and termed as Zabti which was the most important method of assessment of grain production. The tax rate was fixed in money terms as per productivity of each unit of land known as biha. The schedules tax rate in different areas over the year is called dasturs.

Maratha Period

- Shivaji abolished the jagir and zamindari system and established direct contact to the cultivators.

- During his rule the taxation was fixed at 40% of the total produce which could be given in kind or in cash.

- Shivaji introduced two new taxes namely- Chauth and Sardeshmukhi to enhance revenue.

Difference between Chauth and Sardeshmukhi

- Chauth was one fourth of the land revenue paid to the Marathas in order to avoid the Maratha raids. Sardeshmukhi was an additional levy of ten percent on those lands which the Marathas claimed hereditary rights.

- Chauth and sardeshmukhi were the taxes collected not in the Maratha kingdom but in the neighbouring territories of the Mughal Empire or Deccan sultanates.

Also refer :

- Coins Of Ancient And Medieval India

- Download the pdf of Important MCQs From the History Of Ancient India

- List Of Important Inscriptions In India